virginia hybrid tax credit

The credit amount will vary based on the capacity of the battery used to power the. Driving an electric car now comes with added benefits for driving a clean car.

Local Virginia And Maryland Electric Vehicle Tax Credits And Rebates Easterns

Beginning January 1 2022 a resident of the Commonwealth who purchases a new electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500.

. Heavy duty electric truck. Used Vehicles Would Qualify. It is intended to decentralize poverty by enhancing low-income Virginians access to affordable housing units in higher income areas.

Refer to Virginia Code 581-2250 for specifics. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. The legislation will be introduced when the Virginia General Assembly convenes on January 13 2021.

In its final form the program which would begin Jan. Explore Our Alt-Fuel Models Find Yours Today. Medium duty electric truck.

If you take home a new PEV that meets certain requirements such as battery capacity overall vehicle weight and emission standards you can also receive a federal tax credit of up to 2500. Ad Here are some of the tax incentives you can expect if you own an EV car. Read on to find more about the vehicles that qualify for these tax credits.

To entice American taxpayers to go green the government offers numerous federal tax credits for buying a fuel-efficient vehicle such as one of the following. Virginia is for loversand electric-car advocated had hoped that it would soon be for lovers of electric cars and plug-in hybrids too. Light duty passenger vehicle.

Depending on your vehicles battery power the credit amount will vary. President Bidens EV tax credit builds on top of the existing federal EV incentive. HB 1979 proposes that an individual who buys or leases a new or used electric motor vehicle from a dealer in Virginia and registers the vehicle in Virginia would be eligible for a 2500 rebate.

However only the original registered owner of a vehicle can claim the tax credit. Listed below are incentives laws and regulations related to alternative fuels and advanced vehicles for Virginia. An additional 2000.

Federal Tax Incentives for Buying a Fuel-Efficient Car. Your Clean Cities coordinator at Virginia Clean Cities can provide you with information about grants and other opportunities. New all-electric and plug-in hybrid cars purchased in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. Light duty electric truck. You can also access coordinator and other agency contact information in the points of contact section.

Federal Tax Credit Up To 7500. The Qualified Plug-In Electric Drive Motor Vehicle Credit can be worth up to 7500 in nonrefundable credit. Virginia State and Federal Tax Credits for Electric Vehicles - Pohanka Lexus.

All credits have specific eligibility requirements and some require pre-approval or other certification. Many electric vehicles and hybrids currently on the market still qualify for the 7500 federal income tax credit. Alternative fuels are taxed at the same rate as gasoline and gasohol 51 of the statewide average wholesale price of a gallon of self-serve unleaded regular gasoline.

An earlier version of the budget passed by the. Among the more frequently claimed credits are. Residential customers small and large businesses and government agencies.

The incentives may vary by sector but in general there are programs for all types. The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same. Alternative fuels used to operate on-road vehicles are taxed at a rate of 0262 per gasoline gallon equivalent GGE.

A qualified resident of the Commonwealth who purchases such vehicle shall also be eligible for an additional 2000 enhanced rebate. Compare Specs Of Hyundais Alt-Fuel Vehicles Like The IONIQ 5 NEXO Fuel Cell More. It applies to plug-in hybrid vehicles or PHEVs and plug-in electric vehicles EVs or PEVs.

Credit for Taxes Paid to Another State - claimed on Schedule OSC Low Income Individuals Credit - claimed on Schedule ADJ. The hybrid tax credit is the same credit as the EV tax credit for your IRS return. Communities of Opportunity Tax Credit COPTC The Communities of Opportunity Program COP is a Virginia income tax credit program enacted by the 2010 General Assembly 581-4391204 of the Code of Virginia.

A bill proposed in mid-January by Virginia House Delegate. On top of that state andor local incentives may also be applied. An enhanced rebate of 2000 would also be available to buyers whose household income is less than 300 percent of current poverty guidelines.

Key Points of the Hybrid and EV Tax Credit. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

Easterns breaks down tax credits and rebates for Virginia and Maryland electric vehicle owners. The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV. Ad Electric Efficiency With The Range Of Gas.

Virginia offers a number of credits for individual income tax filers. This page lists grants rebates tax credits tax deductions and utility incentives available to encourage the adoption of energy efficiency measures and renewable or alternative energy.

What Exactly Is Your Annual Percentage Rate Apr And What Does It Mean For Your Financial Future Find The Mortgage Tips Improve Your Credit Score Fha Loans

Ford C Max Solar Energi Concept For More Go To Http Www Bravorentacardubai Com Brand Bmw Sportscars Supercars Solar Energy Projects Solar Energy Solar

West Virginia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Is There A Virginia Electric Vehicle Tax Credit Mini Of Sterling

Virginia State And Federal Tax Credits For Electric Vehicles In Chantilly Va Honda Of Chantilly

Hampton Roads International Auto Show Virginia Clean Cities

Electric Vehicles In Virginia Solar United Neighbors

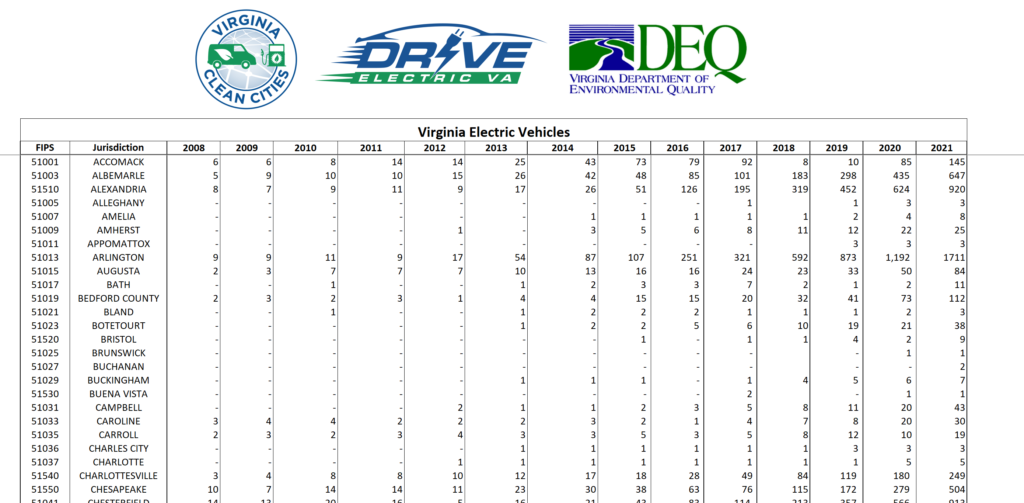

Ev Dashboard Drive Electric Va

Lenders Will Always Verify A Borrower S Income Before Approving A Loan However For The 9 Million People In Amer Home Improvement Loans Home Equity Home Loans

Plug In Hybrid 2022 Hyundai Santa Fe Priced From 40 535 In The U S Carscoops Hyundai Santa Fe Hyundai Latest Cars

Electric Cars Are Better For The Planet And Often Your Budget Too Hybrid Car Electric Cars Nissan Leaf Electric Cars

Virginia State And Federal Tax Credits For Electric Vehicles In Chantilly Va Honda Of Chantilly

Virginia Vehicle Sales Tax Fees Calculator

Virginia Ev Tax Rebate 2022 R Teslamodely

Virginia Ev Rebate Legislation Proposed In 2021 Pluginsites

Virginia Vehicle Sales Tax Fees Calculator

Looking For A Va Mortgage Lender Ask These 9 Questions Of The Lenders You Re Considering To Make Sur Mortgage Tips Mortgage Lenders Improve Your Credit Score